SwiftVirtualPay.com: Revolutionizing Financial Services and Currency Exchange

In today's digital age, financial transactions are becoming increasingly swift and virtual. The emergence of innovative platforms like swiftvirtualpay.com is at the forefront of this transformation, offering comprehensive solutions in financial services, financial advising, and currency exchange. This article aims to delve into the various offerings of swiftvirtualpay.com and how they are shaping the future of finance.

Understanding Financial Services in the Digital Age

The concept of financial services has evolved significantly over the past decade. As more businesses and consumers demand faster, more efficient methods for managing their finances, platforms like swiftvirtualpay.com provide essential services that streamline these processes.

What Are Financial Services?

Financial services encompass a broad range of services designed to manage, invest, and grow wealth. These services include, but are not limited to:

- Banking

- Investment Management

- Insurance

- Payment Processing

- Financial Planning

The Rise of Virtual Payments

As technology continues to advance, the demand for virtual payment systems has surged. swiftvirtualpay.com is an example of a platform that not only simplifies payment processes but also enhances security and efficiency.

Benefits of Virtual Payments

Utilizing virtual payments offers numerous advantages, including:

- Speed: Transactions can be completed in seconds, improving cash flow for businesses.

- Convenience: Users can make payments anytime, anywhere, using their preferred devices.

- Security: Advanced encryption and fraud detection measures protect sensitive financial data.

- Global Reach: Businesses can engage in international transactions with ease, breaking geographical barriers.

Currency Exchange Made Easy

Currency exchange has traditionally been a cumbersome process, often accompanied by high fees and unfavorable rates. However, platforms like swiftvirtualpay.com are redefining how currency exchange is handled, ensuring that businesses and individuals can exchange currency effortlessly.

The Importance of Currency Exchange

In an increasingly globalized economy, the need for efficient currency exchange is paramount. This is essential for:

- Travelers: Individuals traveling abroad need access to local currency without exorbitant fees.

- International Businesses: Companies engaging in cross-border transactions must convert currencies regularly.

- Investors: Investors looking to diversify their portfolios may need to exchange currencies for different assets.

Financial Advising: Expert Guidance for Business Growth

One of the standout features of swiftvirtualpay.com is its commitment to providing top-tier financial advising services. Having access to expert guidance can make a significant difference in business performance and financial health.

What Does Financial Advising Entail?

Financial advising involves offering tailored advice and strategies to help individuals and businesses manage their financial resources more effectively. Services include:

- Investment Advice: Professionals guide clients on where to invest, based on risk tolerance and financial goals.

- Retirement Planning: Advising individuals and businesses on setting up retirement accounts to secure financial futures.

- Tax Strategies: Helping clients reduce their tax liabilities through effective planning and investment.

- Debt Management: Developing personalized plans to help clients effectively manage and reduce debt.

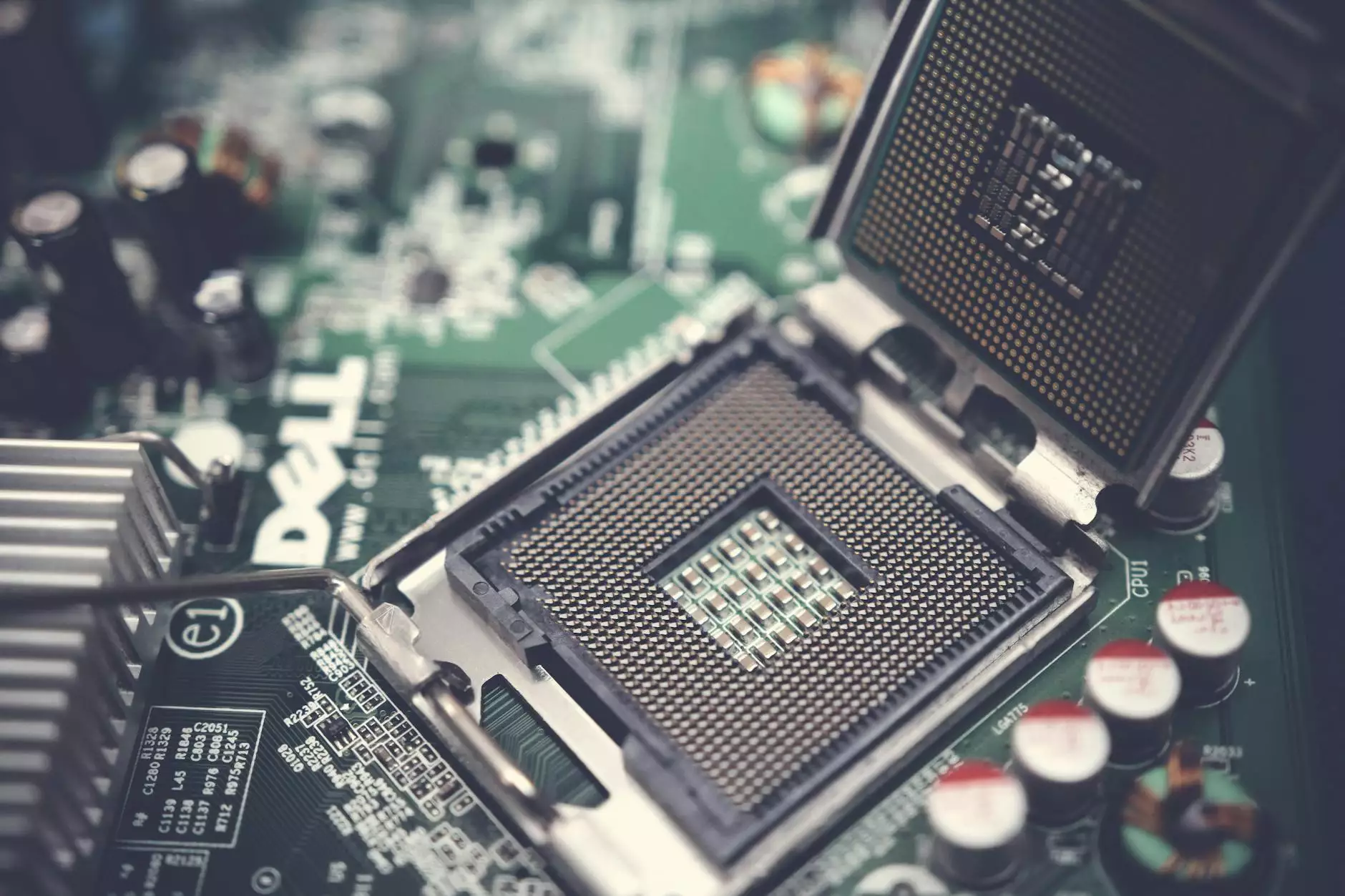

The Technological Backbone of Swift Virtual Payment Solutions

At the core of swiftvirtualpay.com is cutting-edge technology designed to enhance user experience and ensure high performance in transactions. Let’s explore some of the technological innovations that drive this platform.

Blockchain Technology

Blockchain is revolutionizing the financial landscape by providing secure, transparent transaction records. swiftvirtualpay.com utilizes blockchain technology to:

- Enhance Security: Blockchain’s decentralized nature mitigates the risk of fraud.

- Increase Transparency: Every transaction is recorded and can be audited, thus enhancing trust.

- Reduce Costs: Eliminating intermediary banks and fees lowers transaction costs.

AI and Machine Learning

Artificial Intelligence (AI) and machine learning algorithms are employed to optimize financial advising services offered by swiftvirtualpay.com. These technologies can:

- Analyze Consumer Behavior: AI can rapidly analyze data to tailor financial services to individual client needs.

- Predict Market Trends: Machine learning models can be used to forecast market movements and provide valuable advice to clients.

- Enhance Customer Service: AI-powered chatbots can assist users 24/7, answering queries and providing assistance efficiently.

Building Trust in Financial Transactions

Trust is a critical factor in financial transactions. Customers need to feel secure when engaging with financial platforms. swiftvirtualpay.com is committed to building that trust through various means:

Transparent Pricing

One of the main reasons for customer dissatisfaction in financial services is hidden fees. swiftvirtualpay.com provides transparent pricing structures, ensuring that clients know what they are paying for upfront.

Regulatory Compliance

Adhering to regulations is vital in the financial industry. swiftvirtualpay.com ensures compliance with all relevant regulations, fostering trust and reliability among clients.

Conclusion: The Future of Financial Services with Swift Virtual Pay

The emergence of platforms like swiftvirtualpay.com signifies a vital shift in how financial services are delivered. The fusion of technology and expertise promises to enhance the efficiency of financial operations worldwide.

By focusing on providing swift, secure, and uncomplicated financial solutions, swiftvirtualpay.com is set to lead the charge in transforming traditional financial services, making them more accessible and user-friendly for everyone. Businesses and individuals alike can harness the power of virtual payments and professional financial advising to navigate their financial futures with confidence.

In summary, if you're seeking a reliable partner in financial services, currency exchange, and financial advising, look no further than swiftvirtualpay.com. The future of finance is here, and it’s more swift, secure, and virtual than ever before!