The Thriving Market of Forex Broker Companies for Sale

The forex broker company for sale sector has evolved dramatically over the past few years, reflecting the dynamic nature of foreign exchange markets. This growth offers ample opportunities for those looking to invest in or acquire a profitable business. In this article, we explore the intricacies of purchasing a forex broker company, the benefits it brings, and the essential legal considerations involved.

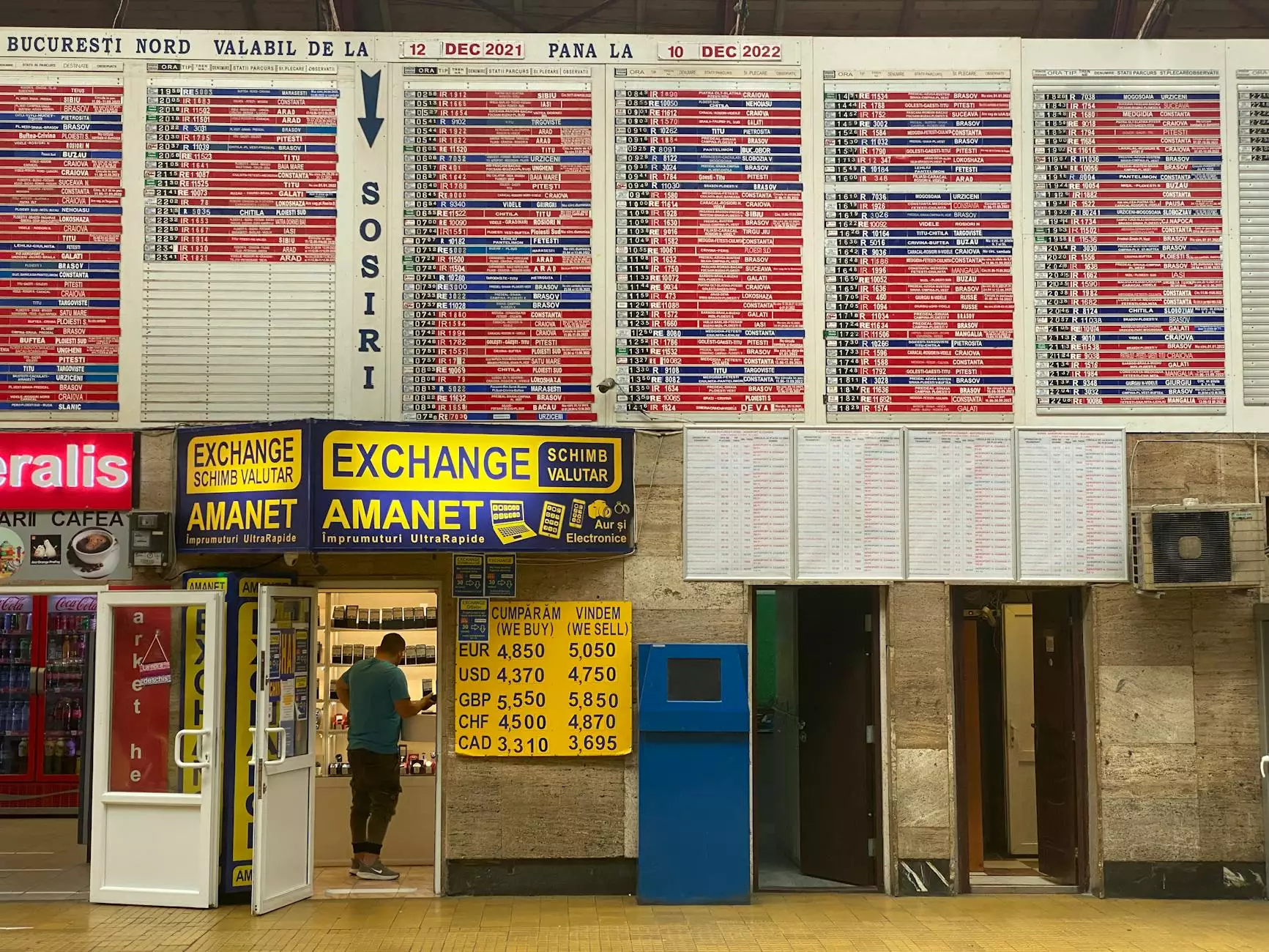

Understanding the Forex Market

The foreign exchange market, commonly known as Forex, is the largest and most liquid market globally. With a daily trading volume exceeding $6 trillion, it presents an attractive opportunity for entrepreneurs and investors alike. The Forex market operates 24 hours a day, five days a week, making it accessible to traders across the globe.

The Appeal of Forex Broker Companies

Investing in a forex broker company for sale can be a lucrative option for several reasons:

- High Demand: As more individuals seek to participate in the Forex market, the demand for brokers continues to rise.

- Established Client Base: Purchasing an existing broker often means inheriting an established clientele, reducing the effort and time needed to build a customer base from scratch.

- Reputation and Brand Identity: An existing broker may have a recognized brand, providing instant credibility that new startups typically lack.

- Regulatory Advantages: A licensed broker already meets the necessary regulatory requirements, ensuring a smoother operational start.

The Process of Buying a Forex Broker Company

Acquiring a forex broker company for sale involves several critical steps. Each phase requires thorough research and legal guidance to ensure a successful transaction.

1. Conduct Thorough Research

Before diving into a purchase, it's essential to perform extensive research on the available options. Key aspects to review include:

- Market Position: Understand where the broker stands in the market. Look into their trading volume, customer retention rates, and overall reputation.

- Financial Health: Review financial statements to assess profitability, liabilities, and cash flow. An analysis of revenues from spreads, commissions, and other services is critical.

- Licensing and Regulations: Ensure that the company holds the appropriate licenses in all jurisdictions it operates. Compliance with regulations is a must to avoid legal issues post-purchase.

2. Valuation of the Company

Determining the value of a forex broker company for sale is a complex process influenced by various factors, such as:

- Assets: Consider the physical and intangible assets the broker possesses, including technology, software licenses, and client databases.

- Revenue Streams: Evaluate different income sources, such as spreads, commissions, and other trading-related services.

- Growth Potential: Analyze market trends and growth metrics, forecasting future potential to increase the company's value.

3. Legal Due Diligence

Engaging professional legal services is vital during the acquisition process. Attorneys specializing in financial and legal agreements can assist in:

- Drafting Agreements: Ensure that all contracts are clearly articulated, protecting interest in the transaction.

- Assessing Liabilities: Investigate any pending legal matters, debts, or regulatory issues attached to the company.

- Compliance Checks: Verify that the company complies with all applicable laws and regulations, which is critical for smooth operation post-acquisition.

Choosing the Right Legal Partner

Having a proficient legal partner can greatly streamline the acquisition process. Eternity Law provides a wealth of experience in professional services, particularly in legal matters related to financial transactions and business acquisitions. Some qualities to look for in legal representation include:

- Experience in Financial Services: Seek a firm with a proven track record in handling forex and financial sector transactions.

- Strong Negotiation Skills: A capable attorney can effectively negotiate terms that serve your best interests.

- Comprehensive Due Diligence: Choose a firm that emphasizes thorough due diligence, leaving no stone unturned in the acquisition process.

Risk Factors in Purchasing a Forex Broker Company

While the opportunities are considerable, several risks must be taken into account when considering a forex broker company for sale:

- Market Volatility: Forex trading is inherently volatile; understanding and managing these risks is crucial.

- Regulatory Changes: The financial industry is subject to rapid regulatory changes, impacting operational practices and cost structures.

- Technological Advances: Staying current with technology is necessary to remain competitive in the rapidly evolving forex market.

Types of Forex Broker Companies

When exploring options for forex broker companies for sale, it’s essential to understand the different types of brokers operating in the market. Each type has its distinct characteristics and may influence your acquisition decision:

1. Market Maker Brokers

Market makers set their own prices and provide liquidity. They profit from the difference between the bid and ask price. Understanding their business model is vital before purchase.

2. ECN Brokers

Electronic Communication Network (ECN) brokers match buyers and sellers directly, offering access to the interbank market. They generally charge a commission per trade rather than profit from spreads.

3. STP Brokers

Straight Through Processing (STP) brokers process orders directly, offering competitive spreads and faster execution. They can provide a hybrid model that combines aspects of both market makers and ECN brokers.

Marketing Strategies for Forex Broker Companies

After acquiring a forex broker company, implementing effective marketing strategies is crucial for growth and visibility. Here are some strategies that can significantly enhance your broker's market presence:

- SEO Optimization: Utilizing effective search engine optimization strategies will help increase organic traffic to your trading platform.

- Content Marketing: Providing valuable content such as market analysis, trading tutorials, and timely news can establish your brand as an authority in forex trading.

- Social Media Engagement: Engaging with potential clients and traders on social platforms helps build community and brand awareness.

Conclusion

Investing in a forex broker company for sale offers a path to participate in one of the most dynamic financial sectors worldwide. With the right preparation, thorough research, and professional legal guidance, you can navigate the complexities of this venture successfully. As you consider this opportunity, remember that the forex market is not only about transactions but also about establishing a reputable business that serves traders around the globe. Leverage the expertise of legal services like those offered by Eternity Law to secure your investment and thrive in the exciting world of forex trading.